2.28.20 Leaping the Virus

What happens when the economy gets a virus?

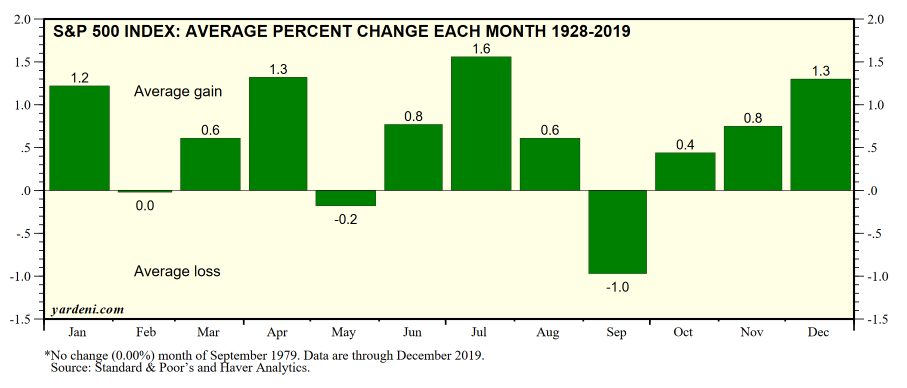

If you look at the growth of the S&P 500 going back to 1926, you’ll find an interesting recurring pattern through the months of an Average Year. Almost all months show a positive return on investment, with the average month seeing an average return of .6%. July has been the big winner, with an average growth of 1.6%. September is the only perennial loser, showing an average loss of -1%. In other words, in an Average Year, stocks grow in value for the first nine months, especially in July, fall back in September, and then grow again through December.

But every fourth year, those statistics go out the window. In the average Leap Year, stocks start out slow, and actually shed -1.3% of value in April and May. But then they, um, leap. We get 2.4% growth in June. 3.2% in July. A ridiculous 4.75% in August. And then positive growth for the rest of the year (including in the normal loser month, September). The average month in a Leap Year shows an average return of over 1.33%.

In other words, Leap Years, on average, start out slower but then leap over the growth rate of Average Years.

How can this be? (Hint: it’s got nothing to do with February 29.)

Keep in mind that Leap Years are also Election Years. (Oh no.)

And sitting politicians like to leap into their next terms. (They wouldn’t!)

The Stock Trader’s Almanac explains, in an article subtly titled, “How the Government Manipulates the Economy to Stay in Power,” in the average Leap Year, the Fed tends to stimulate the economy right before elections. So voters go to the polls feeling flush. So they might suddenly forget any pains of the last term. Which, of course, favors incumbent politicians. And which, of course, piles up more deficit which has to be dealt with in the next term. (But that’s OK, politicians have until the next Leap Year to deal with it, at which point they buy the voters off again.)

Now, will this Leap Year be any different? We’ve already piled up a lot of debt over the past 3 years (where have you gone Grover Norquist?). And just yesterday Goldman Sachs projected that the Corona virus will cause the economy to flatline through 2020. So can we expect that this year politicians will forego their normal tendency to buy off the electorate?

Well, consider this. Going back to World War 2, only twice has the S&P been in the red at the end of a Leap Year. And in both cases – 2008 and 2000 – the incumbent party lost control of the White House.

And now consider this. The Chair of the Federal Reserve, Jerome Powell, has been in his position for just over 2 years. Last summer, when he raised interest rates to slow the economy, Mr. Trump called the move “insane” and loudly complained, “Here’s a guy, nobody ever heard of him before. And now, I made him, and he wants to show how tough he is … He’s not doing a good job.”

So here we go. Do you think the White House might start applying pressure on the Fed to stimulate the economy?

Or will Mr. Powell be left alone to impartially do his job in this time of crisis?

(Believing THAT would take a real leap of faith.)