Leaping Into ’24

This is the year that everyone has to consider whether Bidenomics is working…

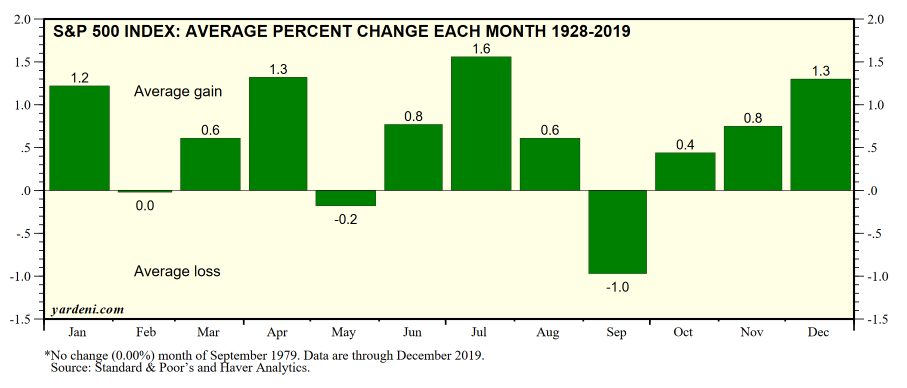

But first, a small enigma. If you look at the growth of the S&P 500 going back to 1926, you’ll find an interesting recurring pattern through the months of an Average Year. Almost all months show a positive return on investment, with the average month seeing an average return of .6%. July has been the big winner, with an average growth of 1.6%. September is the only perennial loser, showing an average loss of -1%. In other words, in an Average Year, stocks grow in value for the first nine months, especially in July, fall back in September, and then grow again through December.

But every fourth year, when we come to a Leap Year, those statistics go out the window. During the average Leap Year, stocks start out slow, and shed -1.3% of value in April and May. But then they, um, leap. We get 2.4% growth in June. 3.2% in July. A ridiculous 4.75% in August. And then positive growth for the rest of the year (including in the normal loser month, September). The average Leap Year shows an average monthly return of over 1.33%.

In other words, Leap Years historically start slower but then leap over the growth rate of Average Years.

How can this be? (Hint: it’s got nothing to do with February 29.)

Keep in mind that Leap Years are also Election Years. (Oh no.)

And sitting politicians like to leap into their next terms. (They wouldn’t!)

The Stock Trader’s Almanac explains, in an article subtly titled, “How the Government Manipulates the Economy to Stay in Power,” in the average Leap Year, the Fed tends to stimulate the economy right before elections. So voters go to the polls feeling flush. So they might suddenly forget any pains of the last term. Which, of course, favors incumbent politicians. And which, of course, piles up more deficit which has to be dealt with in the next term. (But that’s OK, politicians have until the next Leap Year to deal with it, at which point they buy the voters off again.)

Now, will this Leap Year be any different? There going to be lots of discussion about the source of our current huge national debt. Is it a result of Trump’s tax cuts for the rich, or the massive spending we made to deal with the pandemic? Going forward, will you believe the Biden Administration (Democrat) claim that he is lowering the deficit by $3 Trillion over 10 years, or the Congressional Budget Office (Republican) which argues his policies will raise the debt by $20 Trillion over that time?

There’s a lot at stake. Since World War 2, only twice has the S&P been in the red at the end of a Leap Year. And in both cases – 2008 and 2000 – the incumbent party lost control of the White House.

As we head into 2024, most economists are predicting either a “soft landing” – a slowing economy to start the year, followed by modest growth to close it out – or what some are calling a “Goldilocks scenario” – full employment, economic stability, moderating inflation. Either one of which would be a pretty decent reality to live with. So maybe Biden won’t have to play politics, do what his predecessors have done, and artificially stimulate the economy just as we go to the polls…

Unfortunately, given our history, believing that would take a real leap of faith.

Let the economic spin begin.